Sales tax calculator api

The only thing to remember about claiming sales tax and tax forms is to save every receipt for every purchase you intend to claim. If youre interested in using this API please contact Mapbox sales.

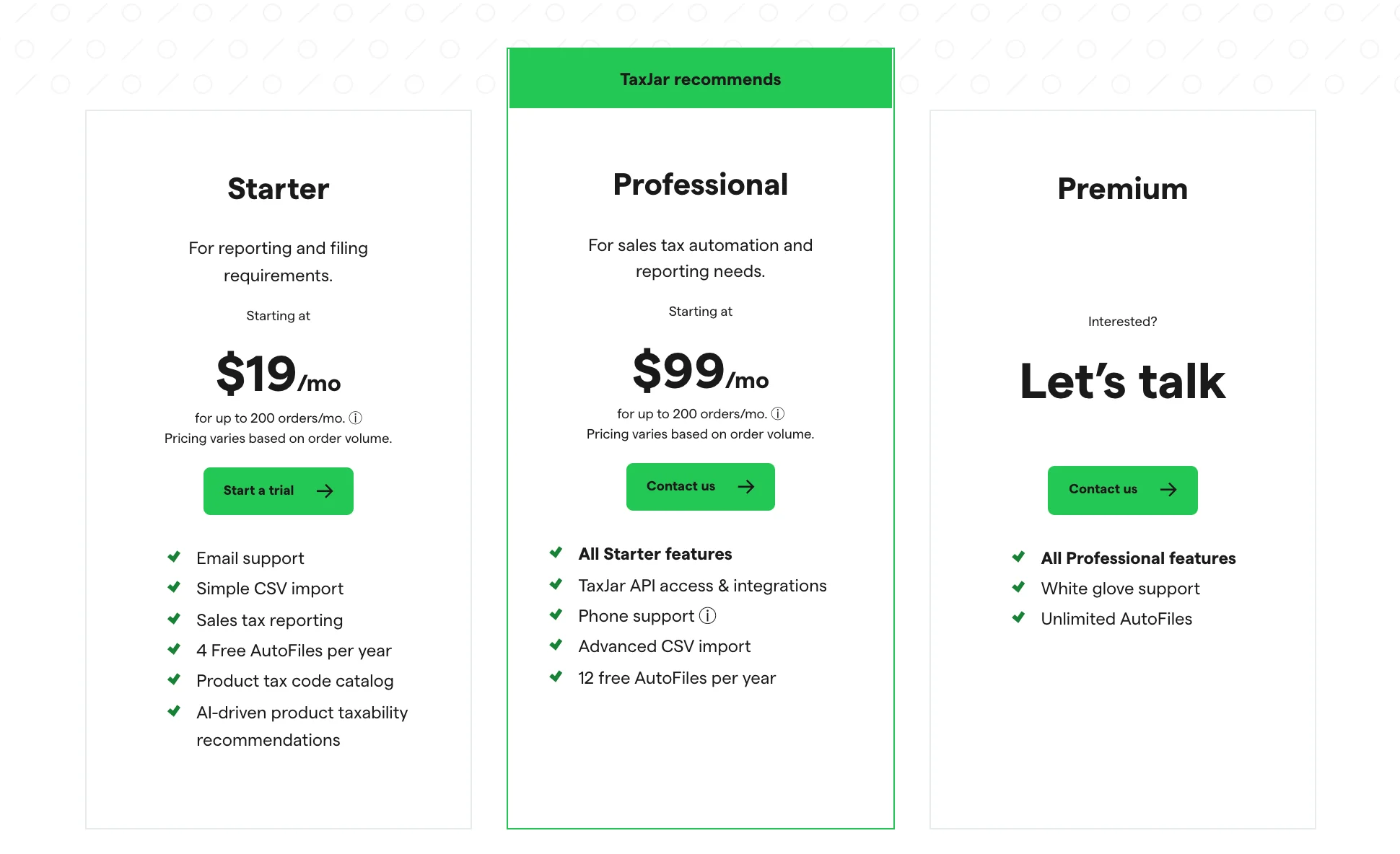

Sales Tax Api Taxjar

Free Sales Tax Calculator plus automated exact-location Tax Rate lookup.

. Thats why we came up with this handy Massachusetts sales tax calculator. Public Relations and Sales Managers 11-2010 Advertising and Promotions Managers. Click here for more about sales tax nexus.

Why A Reverse Sales Tax Calculator is Useful. Simply download the lookup tool and enter your state in this case Massachusetts. Look up 2022 sales tax rates for Tampa Florida and surrounding areas.

Also keep in mind that in the US. If you are not based in Idaho but have sales tax nexus in Idaho then you are only required to charge the 6 use tax rate to your Idaho buyers. First use any USA address for accurate sales tax rates from Avalara real-time data.

Sales tax total value of sale x sales tax rate. Up to date 2022 Louisiana sales tax rates. The state sales tax rate in Alabama is 4.

Public Data API. Get immediate access to our sales tax calculator. The TaxJar API Handles Digital Product Taxability.

These transactions fall under the Japanese consumption tax reverse charge mechanism RCM. In some states sales tax rates rules and regulations are based on the location of the seller and the origin of the sale origin-based sourcing. In New Mexico you will be required to file and remit sales tax either monthly quarterly or semiannually.

Use tax is very similar to sales tax but charged by sellers based out-of-state You can look up your local Idaho sales tax rates by using the TaxJars Sales Tax Calculator. Or make life even easier by using the handy calculator at the top of the page to get the sales tax detail. A Reverse Sales Tax Calculator is useful if you itemize your deductions and claim overpaid local and out-of-state sales taxes on your taxes.

In most states how often you file sales tax is based on the amount of sales tax you collect from buyers in the state. Massachusetts sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Has impacted many state nexus laws and sales tax collection requirements.

You are only required to collect sales tax in states where your business has nexus. Furthermore there may be limited sales taxes called special taxing district rates to help raise money for publicly-funded ventures like new schools parks or rail systems. New Mexico sales tax returns are generally always due the 25th day of the month following the reporting period.

The North Carolina state sales tax rate is currently. Alabama does have local sales tax rates as well so check which sales tax rate you should be using with the TaxJar sales tax calculator. 11-2011 Advertising and Promotions Managers.

Once you know the local sales tax rate for your area you can use the sales tax formula below to figure out how much to charge your customers on each sale. If you are based outside of California but have sales tax nexus in California its simplest and most accurate to charge sales tax based on the sales tax rate at your buyers destination. 13-2080 Tax Examiners Collectors and Preparers and Revenue Agents.

API documentation Find developer guides SDKs tools Existing Partners. Charts for Economic News Releases. The state sales tax rate and use tax rate in California is 725.

Collect Sales Tax When you Have Nexus. How out-of-state sellers should collect sales tax in California. The sales and use tax of any given item or service is the combined rate of a state sales tax rate and any additional local sales taxes levied by a county or city.

Although theres no state sales tax in Alaska many municipalities have a local sales tax and policies vary by locality. Get immediate access to our sales tax calculator. State sales tax rate details Alabama.

API documentation Find developer guides SDKs tools Existing Partners. Pennsylvania is a modified origin-based state. The federal tax was last raised October 1 1993 and is not indexed to inflation which increased 93 from 1993 until 2022On average as of April 2019 state and local taxes and fees add 3424 cents to gasoline and 3589 cents to diesel for a total US volume.

API documentation Find developer guides SDKs tools Existing Partners. The United States federal excise tax on gasoline is 184 cents per gallon and 244 cents per gallon for diesel fuel. Rental price 70 per night.

11-2020 Marketing and Sales Managers. This is the total of state and county sales tax rates. Tennessee sales tax returns are always due the 20th of the month following the reporting period.

In the Kenai Peninsula Borough for example all sellers are REQUIRED to register for sales tax collection emphasis theirs including sellers at temporary events. File a sales. Tax rates are provided by Avalara and updated monthly.

API documentation Find developer guides SDKs tools Existing Partners. On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 percent and 475 percent. Sales tax rules for craft fair sellers.

Use our sales tax calculator or download a free Louisiana sales tax rate table by zip code. The 2018 United States Supreme Court decision in South Dakota v. The Wake County sales tax rate is.

Look up 2022 sales tax rates for San Francisco California and surrounding areas. Look up 2022 sales tax rates for Scottsdale Arizona and surrounding areas. If the filing due date falls on a weekend or holiday sales tax is generally due the next business day.

Currently combined sales tax rates in Illinois range from 625 percent to 11 percent depending on the location of the sale. Get immediate access to our sales tax calculator. If you are not based in Alabama but have sales tax nexus in.

Download sales tax lookup tool. If youre working with a developer they can take advantage of the Avatax API to build sales tax rate determination into your application. GPS coordinates of the accommodation Latitude 43825N BANDOL T2 of 36 m2 for 3 people max in a villa with garden and swimming pool to be shared with the owners 5 mins from the coastal path.

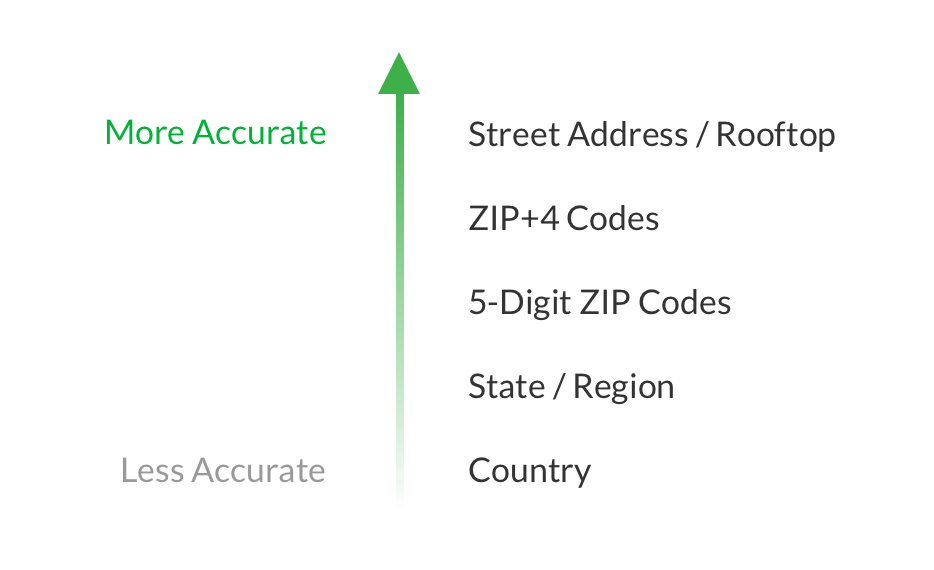

Calculate how much sales tax you owe. If your company is a Japanese corporation your company that received the service listed above will be obliged to pay consumption tax to Japanese tax. In others sales tax is based on the location of the buyer and the destination of the sale destination-based sourcing.

Up to date 2022 Louisiana sales tax rates. By their logic digital books would be taxable but digital textbooks are tax exempt. When it comes time to file sales tax in Tennessee you must do two things.

How To Charge Shopify Sales Tax On Your Store Sep 2022

What Is Sales Tax Nexus Learn All About Nexus

Best Sales Tax Calculator For Us States And Other Countries Geekflare

Sales Tax Api Powered By Sovos Simple Connect Api

Sales Tax Api Taxjar

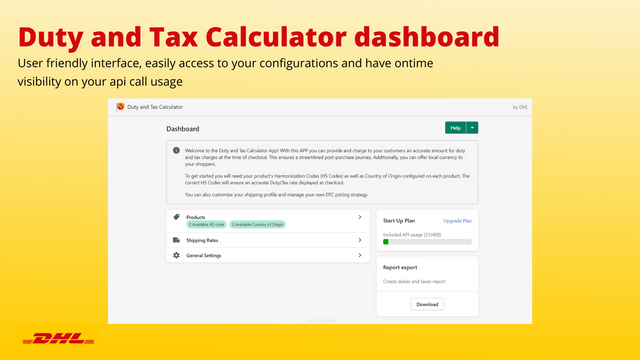

Duty And Tax Calculator Simplify Your Business With Duties And Taxes At Checkout Shopify App Store

Best Sales Tax Calculator For Us States And Other Countries Geekflare

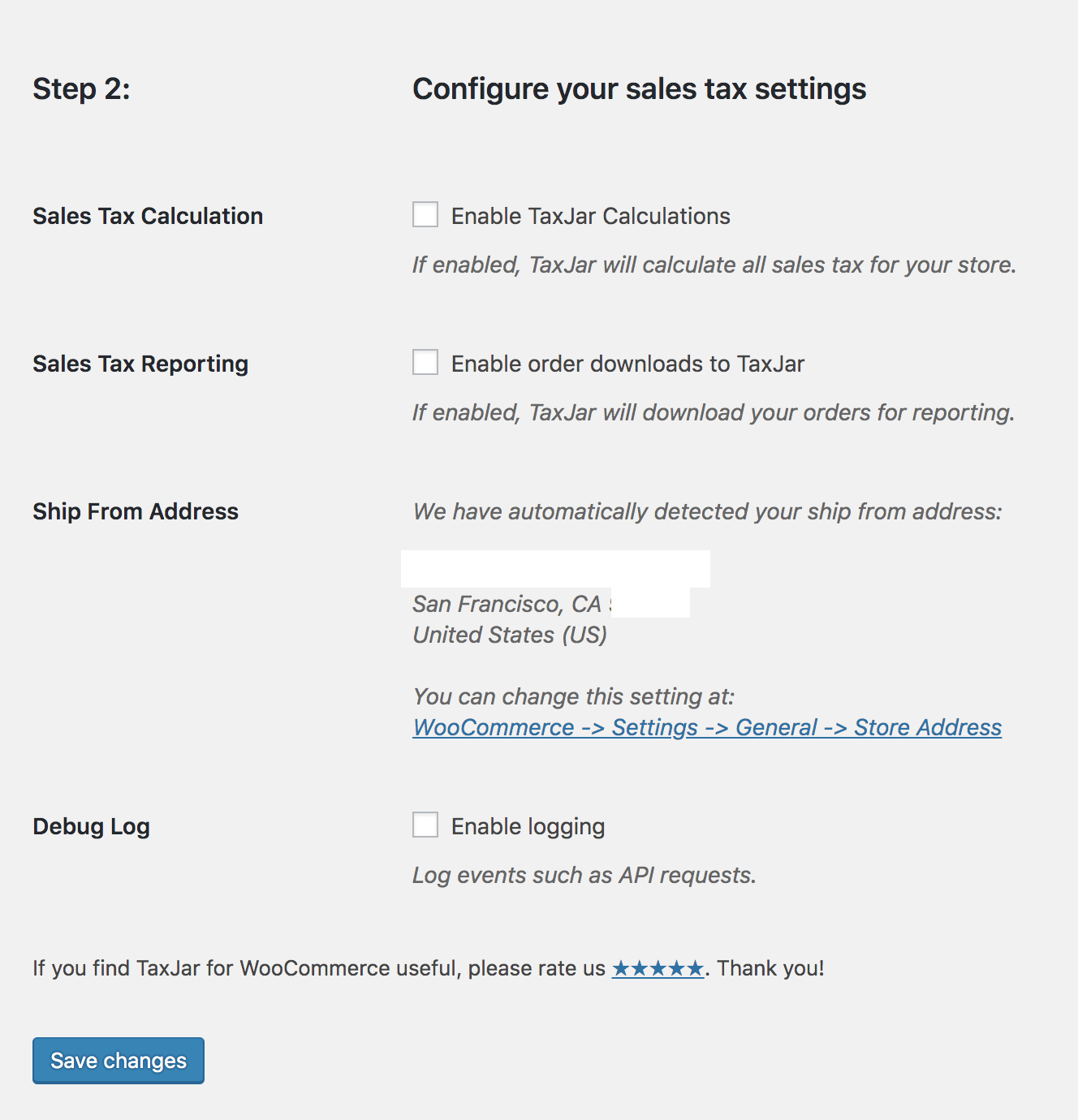

Taxjar For Woocommerce Woocommerce

What S The Best Api To Calculate Sales Tax Within A Modern Web App Quora

Sales Tax Calculations Taxjar Developers

Sales Tax Api Taxjar

Sales Tax Calculator Taxjar

Stripe Tax Automate Tax Collection On Your Stripe Transactions

5 Tax Apis Free Alternatives List September 2022 Rapidapi

Sales Tax Api Taxjar

Best Sales Tax Calculator For Us States And Other Countries Geekflare

Github Taxjar Taxjar Php Sales Tax Api Client For Php 5 5